Popular retirement funds suffer as tech stocks plunge

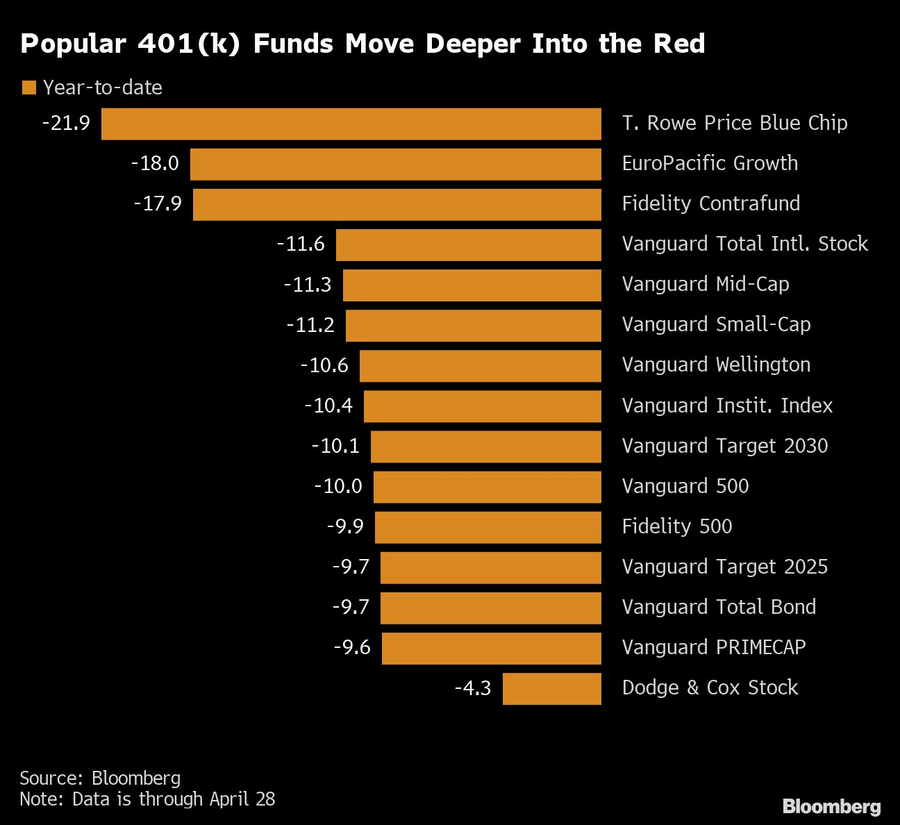

Many growth-oriented stock funds offered in 401(k) plans are down more than 10% so far this year.

Anyone who dares peek at their 401(k) can see the carnage: Many popular funds in workplace retirement savings plans are down more than 10% so far this year. Some are even in, or approaching, bear market territory.

Many of the retirement funds are, unsurprisingly, growth-oriented and heavy on on mega-cap tech stocks such as Amazon.com Inc., which plunged Friday after the e-commerce giant reported a quarterly loss and said it may lose money again in the current period.

The epic bull run in mega-cap tech that began in March 2020 led many funds to become ever more concentrated in a handful of companies. The T. Rowe Price Blue Chip Growth fund, for example, held more than 46% of the fund in five stocks as of March 31 — Microsoft Corp. (11.6%), Amazon (10.9%), Alphabet Inc. (10.2%), Apple Inc. (8.7%) and Meta Platforms Inc. (5%) — and more than 60% of its assets in the top 10 stocks. The fund is now down almost 22% for the year.

Fidelity Contrafund, another big 401(k) plan favorite, held about 33% of the fund in its top five holdings as of Feb. 28, with Amazon its top stock, at 8%. Contrafund is now down almost 18% year-to-date.

The S&P 500 has lost more than 10% so far this year. While the recent volatility is gut-wrenching for many people nearing or in retirement, it’s an opportunity for millennial investors, said financial planner Thomas Kopelman, the 27-year-old co-founder of AllStreetWealth.

“For young people, the market going down is okay since you aren’t going to be using this money for a very long time,” Kopelman said. “So get the money in, and stop waiting for the perfect time to buy the dip.”

Learn more about reprints and licensing for this article.